Investment Philosophy

Attivo Investments takes an innovative approach to Investment Leadership by utlising a Co- CIO framework and has selected SEI as their partner. We have leveraged our deep understanding of the financial planning and retail client sectors to build an investment business not just designed to deliver to Financial Planners of today but also to innovate and deliver new solutions as they are required.

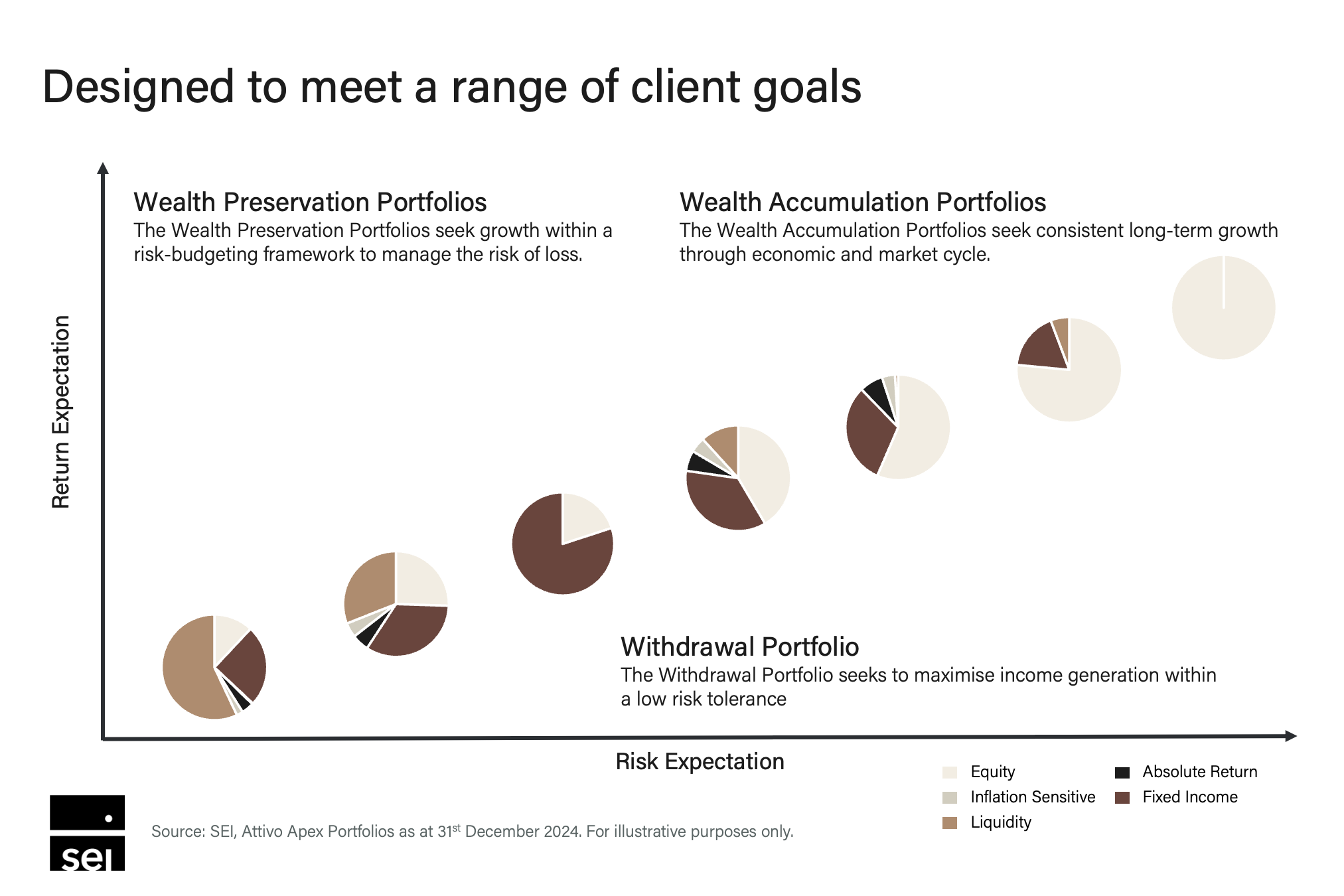

Goal Based Investing

Our philosophy revolves around Goal-Based Investment Theory, prioritising outcomes over returns. We align investments with specific financial goals highlighted by Financial Planners—whether accumulating wealth, preserving it, or generating income. This approach helps clients remain focused during market volatility and achieve their long-term objectives.

Global Expertise and Strategic Partnerships

Attivo collaborates with SEI, a global leader with 120 specialists, $6 trillion in assets under influence, and $400 billion in assets under management. This partnership provides economies of scale, competitive pricing for underlying clients, and a framework for continuous innovation.

Adapting to a Changing Investment Landscape

Attivo’s goal-based investing approach is designed to navigate complex global challenges, including geopolitical uncertainties, higher interest rates, inflation, leadership changes, slower growth, shifting global economic dynamics, and the transition to net zero.

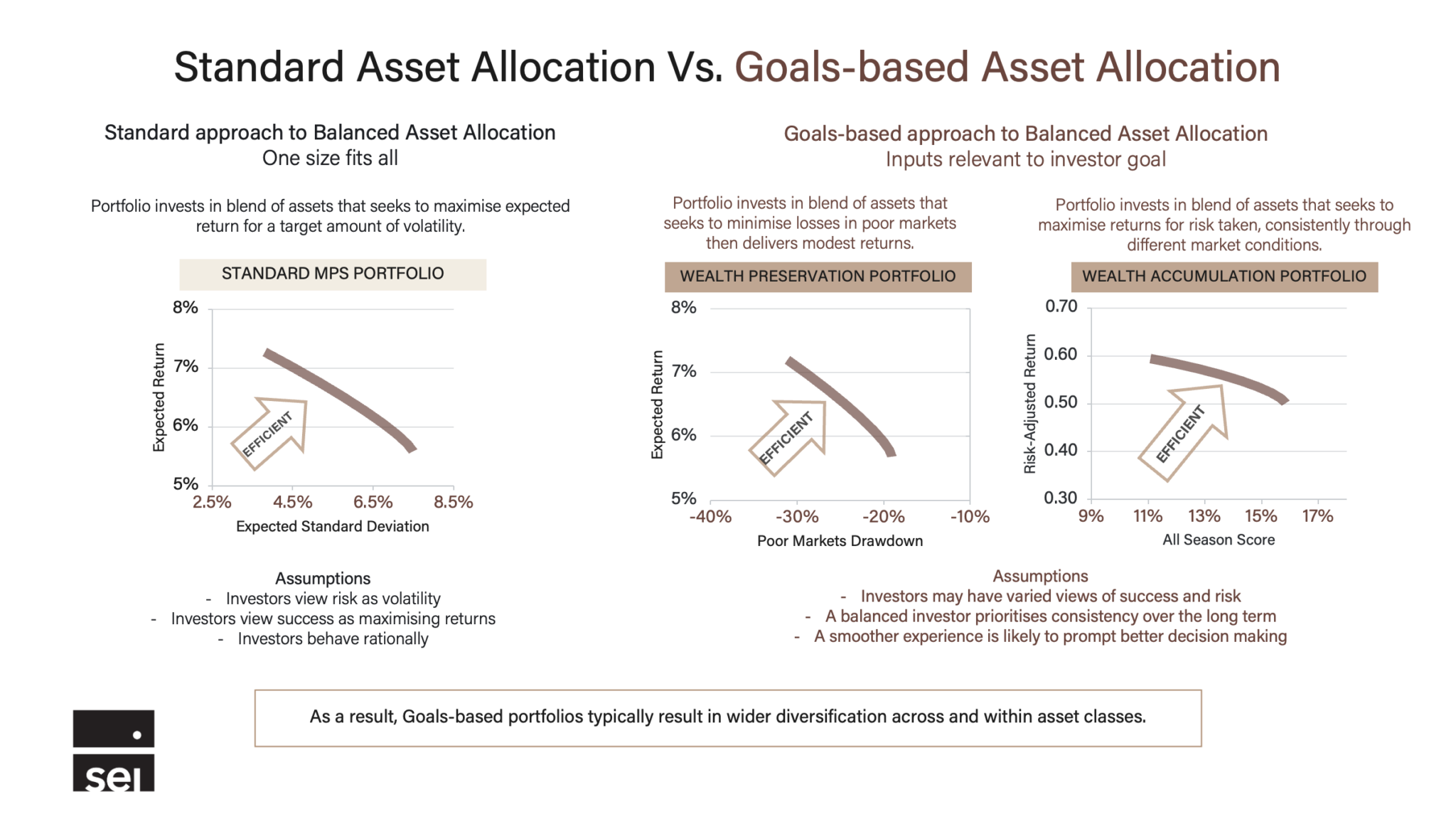

Standard vs. Goal-Based Asset Allocation

Traditional asset allocation focuses on maximizing returns for a target level of volatility but often lacks the flexibility to address unique client objectives. Goal-based asset allocation tailors strategies to specific financial goals, such as wealth preservation or income generation, each with its own risk parameters. This approach enhances the investment experience by aligning outcomes with client expectations and delivering more personalised results.

A Modern Investment Philosophy

Attivo Investments employs a forward-thinking approach, offering diversification and asset allocation strategies distinct from peers. Its portfolios provide access to exclusive asset classes, institutional-grade share classes, and strategies not typically available to private clients. Active risk management ensures stability during market downturns, using institutional-grade tools for transparency and control.

Rigorous Research and Manager Selection

Attivo’s disciplined research process identifies best-in-class managers through a combination of quantitative and qualitative analysis. Continuous monitoring ensures alignment with client goals and sustained performance.

Preservation

The Preservation goal based models offer security for those who wish to preserve wealth over time. The primary objective is to safeguard accumulated assets while generating safe, steady returns, focusing on wealth conservation for goals such as retirement income, inheritance or maintaining purchasing power during market volatility.

Accumulation & Withdrawal

The Accumulation goal based models offer peace of mind for those who prefer disciplined, long-term planning to meet their financial goals with less focus on day-to-day market changes. The primary objective is to accumulate assets and build a financial foundation for future goals such as retirement, pensions or significant life milestones. The withdrawal goal based model is designed for investors seeking steady income generation from their portfolio. This strategy focuses on income generating assets with a monthly distribution to replicate a salary type payment. It provides a reliable flow of earnings without the need for aggressive growth or excessive risk taking.

Investment Strategies

Six cost-efficient Model Portfolios designed with a light goal-based framework. These portfolios leverage passive investment building blocks to replicate market performance as it rises and falls. Constructed within a fund-of-funds structure, they provide a simple, transparent, and cost-effective solution for achieving long-term investment objectives.

The models

Low-Cost Models with a Preservation Goal

Low-Cost Preservation Conservative

Low-Cost Preservation Cautious

Low-Cost Preservation Moderate

Low-Cost Models with an Accumulation Goal

Low-Cost Accumulation Balanced

Low-Cost Accumulation Progressive

Low-Cost Accumulation Growth

A range of six heavily goal-based Core Model Portfolios designed with asset allocation tailored to achieve specific client objectives. Utilising a manager-of-managers approach, these portfolios focus on reducing trade frequency and capital gains tax (CGT) realisation, ensuring greater efficiency. Active downside protection is integrated to safeguard against market downturns, while additional alpha is generated through high-conviction managers. This strategy provides clients with the very best investment exposure, blending superior cost efficiency with access to elite investment expertise.

The models

Core Models with a Preservation Goal

Core Preservation Conservative

Core Preservation Cautious

Core Preservation Moderate

Core Models with an Accumulation Goal

Core Accumulation Balanced

Core Accumulation Progressive

Core Accumulation Growth

Core Models with an Withdrawal Goal

IT Core Withdrawal Moderate

An unconstrained strategy involving a wide range of asset classes, designed for high net worth and experienced investors. It includes additional asset classes like private equity or hedge funds, providing more flexibility and higher potential returns but also higher risk and fees. For a client that may have had a bespoke investment management and felt the fees were too expensive but wanted more than an average model portfolio.

The models

Apex Models with a Preservation Goal

Apex Preservation Conservative

Apex Preservation Cautious

Apex Preservation Moderate

Apex Models with an Accumulation Goal

Apex Accumulation Balanced

Apex Accumulation Progressive

Apex Accumulation Growth

Six cost-efficient Model Portfolios designed with a light goal-based framework. These portfolios leverage passive investment building blocks to replicate market performance as it rises and falls. Constructed within a fund-of-funds structure, they provide a simple, transparent, and cost-effective solution for achieving long-term investment objectives.

A range of six heavily goal-based Core Model Portfolios designed with asset allocation tailored to achieve specific client objectives. Utilising a manager-of-managers approach, these portfolios focus on reducing trade frequency and capital gains tax (CGT) realisation, ensuring greater efficiency. Active downside protection is integrated to safeguard against market downturns, while additional alpha is generated through high-conviction managers. This strategy provides clients with the very best investment exposure, blending superior cost efficiency with access to elite investment expertise.

An unconstrained strategy involving a wide range of asset classes, designed for high net worth and experienced investors. It includes additional asset classes like private equity or hedge funds, providing more flexibility and higher potential returns but also higher risk and fees. For a client that may have had a bespoke investment management and felt the fees were too expensive but wanted more than an average model portfolio.

The models

Low-Cost Models with a Preservation Goal

Low-Cost Preservation Conservative

Low-Cost Preservation Cautious

Low-Cost Preservation Moderate

Low-Cost Models with an Accumulation Goal

Low-Cost Accumulation Balanced

Low-Cost Accumulation Progressive

Low-Cost Accumulation Growth

The models

Core Models with a Preservation Goal

Core Preservation Conservative

Core Preservation Cautious

Core Preservation Moderate

Core Models with an Accumulation Goal

Core Accumulation Balanced

Core Accumulation Progressive

Core Accumulation Growth

Core Models with an Withdrawal Goal

IT Core Withdrawal Moderate

The models

Apex Models with a Preservation Goal

Apex Preservation Conservative

Apex Preservation Cautious

Apex Preservation Moderate

Apex Models with an Accumulation Goal

Apex Accumulation Balanced

Apex Accumulation Progressive

Apex Accumulation Growth

Characteristics of the Low-Cost MPS Range

Our Low-Cost portfolios are designed for investors who are comfortable with the prospect of heightened volatility in exchange for lower costs. This might include those looking to accumulate funds towards a long-term goal aiming to minimise fees or those who are new to investing and require straight forward low-cost diversified investment solutions.

Low-Cost Light Goal Based

Passive Funds of Funds Structure

Characteristics of the Core MPS Range

Our Core portfolios are designed for investors who are looking to strike a balance between controlling cost and generating above-average returns via active management. Our Core portfolios have an enhanced investment strategy relative to the Low-Cost portfolios which we feel can add more value over time.

Optimal Goal Based enhancing downside protection

Active Building Blocks

Additional Alpha Sources

Manager of Manager

Benefits of the APEX MPS Range

Our Apex portfolios are designed for investors who are looking to maximise the potential for excess returns via active management, with a dynamic overlay. These portfolios are for sophisticated investors and will include a higher amount of alternative assets such as hedge funds.

Optimal Goal Based Enhanced downside protection

Active Building Blocks With Dynamic Overlay

Additional Alpha alongside Dynamic Asset Allocation and Hedge Fund Exposure

Manager of Manager

Making investment solutions easier to be mapped to client goals, objectives, and aspirations.